Collateralized Loan Obligations (CLOs) have become an integral part of the credit investment landscape, offering unique opportunities for investors looking to tap into the leveraged loan market. Within this structured product, CLO equity stands out as the riskiest but potentially most rewarding component. A successful CLO investment in the equity tranche requires a deep understanding of loan performance, manager strategy, and structural protections to effectively balance risk and return. Understanding how CLO equity is structured and how it generates returns is essential for sophisticated investors seeking higher yield opportunities through structured finance.

CLO equity isn’t just a high-risk, high-reward play—it is a carefully engineered investment vehicle that leverages senior secured loans to deliver cash flow to investors. However, with complexity comes the need for clarity. Let’s explore how CLO equity is built, how it functions, and what drives its performance.

Contents

What Is CLO Equity?

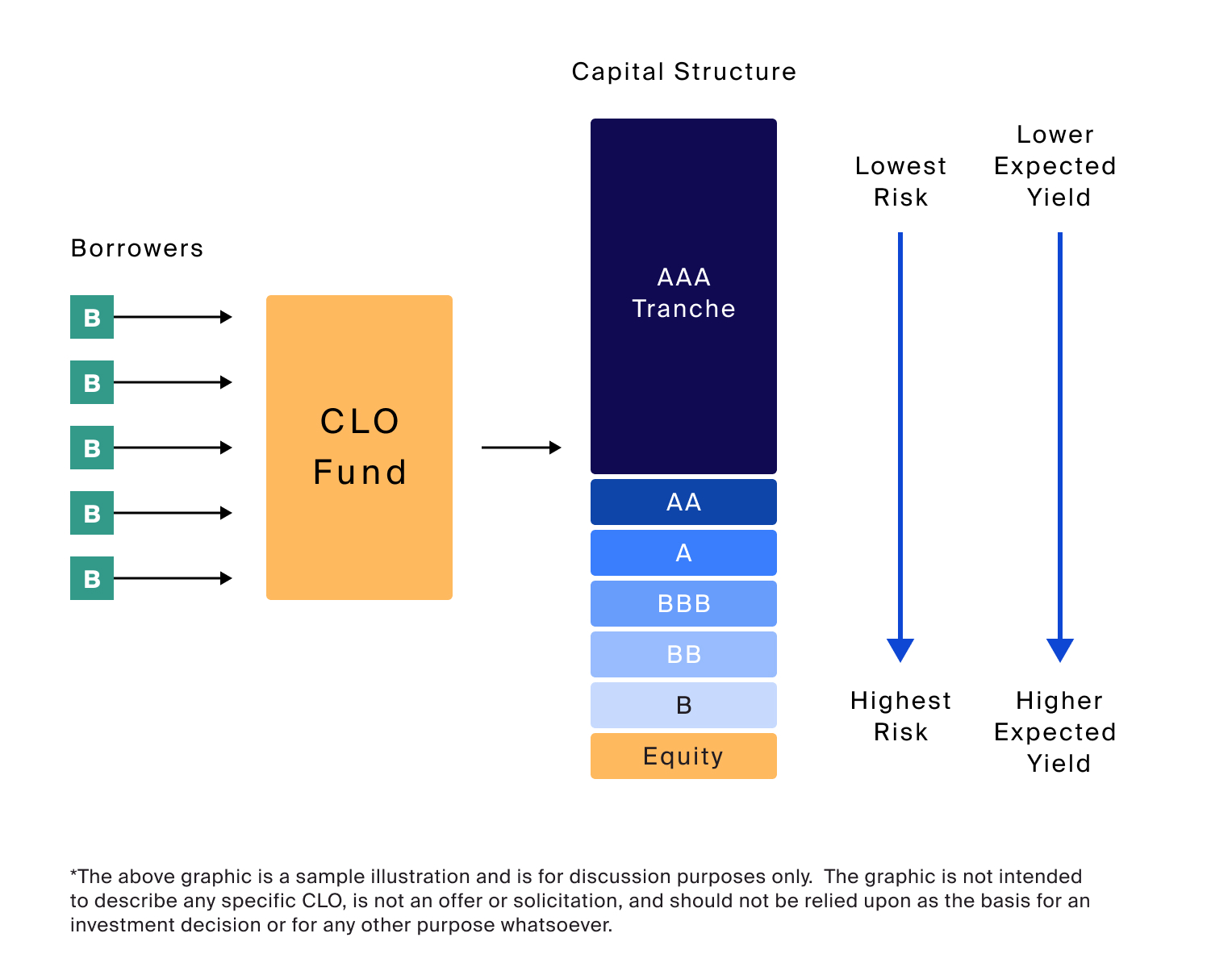

A CLO is a securitized portfolio of broadly syndicated loans made to corporate borrowers, typically those with below-investment-grade credit ratings. These loans are bundled into a vehicle that issues multiple tranches of securities, ranked by risk and return. The tranches include senior debt (AAA through BBB-rated), subordinated debt (often BB-rated), and finally, the equity tranche.

CLO equity represents the bottom layer of the capital structure—the first to absorb losses and the last to receive payments. However, this junior position also benefits from the residual cash flows after all obligations to debt tranches are met. In essence, CLO equity investors hold a leveraged claim on the underlying loan portfolio’s performance.

How Is CLO Equity Structured?

The structure of a CLO is designed to protect the higher-rated debt tranches while still offering return potential for equity holders. Here’s how the capital stack typically works:

- Senior Debt Tranches: Receive interest payments first and are the most secure. These tranches carry the lowest risk and yield.

- Mezzanine Debt: Next in priority, offering higher yields but with more risk.

- Equity Tranche: Takes on the most risk, as it only receives payments after all debt tranches are satisfied.

Despite being last in line, CLO equity has the potential to generate significant returns. This is largely due to the “excess spread,” which is the difference between the interest received from the loan pool and the interest paid to debt investors. After administrative and management costs, the remaining cash flow belongs to the equity holders.

Return Components Of CLO Equity

CLO equity returns are driven by several key factors:

- Excess Spread: CLO portfolios typically generate interest income at floating rates (e.g., LIBOR or SOFR + margin). The cost of the debt tranches is usually lower than the income from the underlying loans, allowing for an excess spread. This difference creates the primary source of income for equity investors.

- Reinvestment Opportunities: During the reinvestment period (usually the first 4–5 years of a CLO’s life), managers can reinvest proceeds from loan repayments into new loans. Skilled managers can take advantage of market pricing inefficiencies to enhance the portfolio and generate additional income.

- Optional Call Rights: CLO equity holders often benefit from call rights after the non-call period (typically 2 years). This allows the CLO to be refinanced or reset under more favorable terms, which can boost equity returns or unlock value earlier.

- Leverage: The inherent leverage in the CLO structure amplifies returns on equity when the loan portfolio performs well. However, it also increases downside exposure in the event of loan defaults or deteriorating credit quality.

Risks To Consider

While the return potential is appealing, CLO equity also carries significant risk. Since equity holders are the first to absorb losses, deteriorating credit conditions or high default rates can quickly erode returns. Performance can also be adversely affected by market volatility, growing interest rates, and inadequate portfolio management.

Liquidity is another factor. CLO equity is less liquid than bonds or public stocks, particularly when the market is down. Investors need to have a long-term horizon and a strong understanding of structured finance.

Conclusion

CLO equity offers an attractive opportunity for investors who are comfortable with higher complexity and risk. Its structure enables exposure to a diversified pool of leveraged loans with the potential for double-digit returns, driven by excess spread, reinvestment strategies, and optional call features. However, those returns come with significant volatility and downside risk. Understanding how CLO equity is structured—and what influences its performance—is essential to making informed investment decisions. For experienced investors seeking yield enhancement and diversification, CLO equity remains a compelling but nuanced option in the broader credit market.